What is GST ?

Starting off with what is GST (Goods and Service Tax), it is a destination-based tax based on the consumption of services and goods. Replacing the multiple State and Central Government taxes, the GST came into effect on July 1, 2017. The GST Council which contains a finance minister of central and all states governs the rules, rates, gst certificate and regulations with GST Registration.

It tax varies from 0% to 28% depending upon the nature of good and services that you consume. Also, the GST is paid by consumers and it provides revenue for the Government. Now let’s talk about GST registration.

Get Expert Advice

What is GST Registration

The GST Registration is mandatory for every business whose turnover crosses 40 Lakhs per annum or 10 Lakhs for few businesses in hill areas according to the amendment from April 1, 2019. However, there are few businesses as well for whom the registration is mandatory even if the business didn’t exceed the pre-defined turnover. For example, any time of e-commerce business is mandatory to have GST certificate. Business having higher turnover but not having GST registration may face heavy penalties as per the law.

The process is fairly easy and the entire process takes around 2-7 working days.

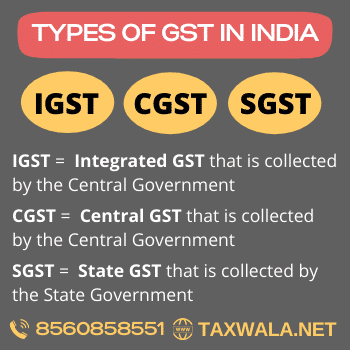

Types of GST in India

- SGST (State Goods and Services Tax)

- CGST (Central Goods and Services Tax)

- IGST (Integrated Goods and Services Tax)

- UGST (Union Territory Goods and Services Tax)

Required Documents for GST Registration / GST Certificate

There are a few documents that are mandatory for the process. The list is below mentioned.

Check List for Proprietorship / Individual

- PAN Card

- Aadhaar Card

- Passport Size Photograph

- Any 2 Business Address Proof (Electricity Bill, Property Document, Rent Agreement, NOC, Consent Letter)

- Cancelled Cheque / Bank Statements

- Email Id, Mobile No

- Business Name and Business Activities

Check List for HUF (Hindu Undivided Family)

- PAN Card of Karta

- Aadhaar Card of Karta

- Passport Size Photograph of Karta

- HUF Deed

- PAN Card of HUF

- Authorization Letter

- Any 2 Business Address Proof (Electricity Bill, Property Document, Rent Agreement, NOC, Consent Letter)

- Cancelled Cheque / Bank Statements

- Email Id, Mobile No

- Business Name and Business Activities

Check List for Partnership Firm

- PAN Card of each Partner

- Aadhaar Card of each Partner

- Passport Size Photograph of each Partner

- Partnership Deed

- PAN Card of Partnership Firm

- Primary Signatory Authorization Letter

- Any 2 Business Address Proof (Electricity Bill, Property Document, Rent Agreement, NOC, Consent Letter)

- Cancelled Cheque / Bank Statements

- Email Id, Mobile No of each Partner

- Business Name and Business Activities

Check List for Company / LLP

- PAN Card of each Director / Designating Partner

- Aadhaar Card of each Director / Designating Partner

- Passport Size Photograph of each Director / Designating Partner

- COI (CIN No) / LLPIN Certificate

- PAN Card of Company / LLP

- Primary Signatory Authorization Letter

- Any 2 Business Address Proof (Electricity Bill, Property Document, Rent Agreement, NOC, Consent Letter)

- Cancelled Cheque / Bank Statements

- DIN No / DPIN No, Email Id, Mobile No of each Director / Designating Partner

- Business Name and Business Activities

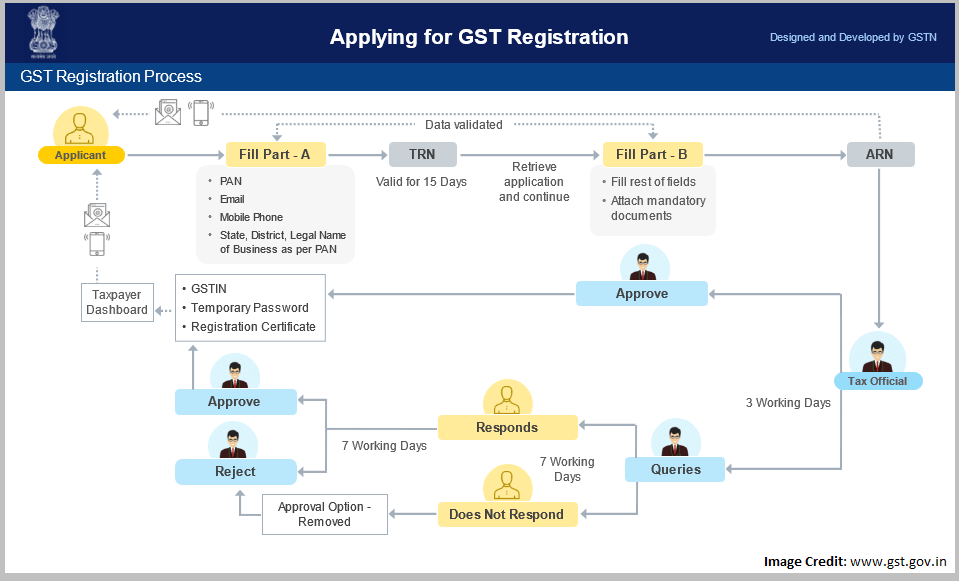

Procedure for GST Registration

Here are the few steps which you can follow to get GST registered

- Fill the contact form and our agents will reach out to us or directly call us on the given numbers.

- An expert will be assigned to execute the process.

- Provide/arrange all the mandatory documents for GST registration.

- Documents will be submitted to the GST portal after verification

- ARN Number is generated

- GSTIN will be received within 2-7 working days on Email.

Benefits of GST Registration

- A good number of products and/or services are either exempt from tax or charged at 5% or less.

- The poor will receive their due.

- Small traders will find themselves on a level playing field.

- Simplified tax structure with fewer exemptions.

- Products and services will be allowed to move freely across the country.

- Increased competition between manufacturers and businesses will benefit consumers.

- Items such as movie-ticket prices, two-wheelers, televisions, stoves, washing machines, SUVs and luxury cars, two-wheelers, etc. will be cheaper.

Who Needs GST Registration?

- Any supplier of goods and/or services who makes a taxable supply with an aggregate turnover of over Rs.20 lakhs in a financial year is required to obtain GST registration. In special category states, the aggregate turnover criteria is set at Rs.10 lakhs.

- If you are providing services and goods outside the Country.

- Selling your goods or services online (like selling on Flipkart, Amazon, and Jio Store etc).

- If a business has Earlier registration under VAT, Excise Laws, Service Tax Laws.

- If the business is dealing in multiple states.

What are the Different Types of GST Registration?

- Compulsory Registration: Under certain scenarios, the businesses have to get registration under GST.

- Voluntary Registration: The business does not have the liability to register under GST, however, can apply for GST Registration. This usually is when the businesses are willing to take advantage of the Input Tax Credit facility.

- Registration under Composition Scheme: Composition scheme is a voluntary and optional scheme for registering under GST. Under the composition scheme, the compliance is simpler and lesser returns are to be filed. The tax is to be filed at a fixed rate. If the maximum business turnover is rs. 1.5 Crores and sale is within state, they can opt for GST Registration under Composition Scheme.

- No Registration: In the case, when your business does not fall under the conditions for compulsory registration you do not require GST Registration.

Guidance for Opening of Business “Current Account”

Automate Your Business Finances with Open Business Account. Start Today! Simplified SMB / Merchant / Foreign Banking Experience. Run Your Finances on Autopilot with Open. Insightful Reports. Bulk Payouts. Easy-to-use Dashboard. Types: Current Account, Inbuilt Bookkeeping, Payment Gateway, Hassle-Free Merchant Solutions, Credit Facility etc.

- Zero Balance Current Account

- Same-day account activation.

- Unlimited Transactions like IMPS, UPI, NEFT, and RTGS.

- Online Internet Banking Services.

- Mobile App Banking Services.

- Free Cheque Book.

- Loan and Business Credit Facility

Free Accounting & Billing Software

The final list of Accounting and Billing Software products that are being made available free of cost to all tax payers (of annual turnover < INR 1.5 crore) is given below:-

| Sr. No. | Name of Company | Product Name | Cloud / On-prem | Mobile App |

|---|---|---|---|---|

| 1 | Adaequare Info Private Limited | uBooks | Cloud | Yes |

| 2 | Cygnet Infotech Private Limited | Cygnet FACE | On-prem | No |

| 3 | Focus Softnet Private Limited | FocusLyte | Cloud | No |

| 4 | IRIS Business Services Limited | CaptainBiz (formerly Vyapari) | Cloud | Yes |

| 5 | Relyon Softech Limited | Saral Accounts | On-prem | Yes |

| 6 | Seshaasai Business Forms Private Limited | GenieBooks | Cloud | Yes |

| 7 | Zoho Corporation Private Limited | Zoho Books | Cloud | Yes |

Penalty for not registering GST

If your business is not GST Registration, you can face penalties. IF you are paying less, which might be a genuine mistake, you will be charged 10% of the tax amount (Rs. 10,000 minimum) as penalty. However, if you are evading the tax completely, you might have to pay as much as 100% of the GST amount.

So do not wait around and get your business registered if you don’t want to face heavy penalties. Avail our affordable GST Registration / GST Certificate service today and leave all your problems / tensions with us. With years of experience, we have a huge customer base of highly satisfies customers / taxpayers, so don’t wait out and contact us right now.

Why Choose Us

TaxWala has been in service for years now and we know how to help customers in the best way possible. Our service highly customer-centric which means 100% service satisfaction always. Here are a few years for choosing TaxWala.

Value for Money

Compared to our competitors, our service is much pocket friendly which means you get higher value for money to get Tax Registration Certificate (Goods and Service Tax). You will get your GST Tax Certificate in 7 working days. Department of Taxation is provided free GST Registration and but consultant can take only just normal fees.

Responsive Team For GST Registration

As soon as you fill the contact form to avail of our GST Registration / GST Certificate service, our team will contact you as soon as earlier and help you out with the process.

We are the Experts

Our team of expert (GST Tax) will make the entire process really easy for you so you don’t have to worry about anything going wrong anymore

FAQs

GSTIN stands for Goods and Services Tax Identification Number

Less Tax Liability, High working capital, take input tax credit, Make interstate sales with restriction and much more.

It is a 15-digit unique tax identification number similar to the PAN number. For example, For Ex – 08XXXX1111X1ZX

The present system for E-way Bill in States to continue, till the E-Way Bill procedures are finalized.

CGST credit can be first used to set off CGST liability. Whatever is left can be used to set off IGST liability. It cannot be used to set off SGST liability. Please see Section 49 of the CGST Act, 2017.

Refer Section 2(6) of CGST Act. Aggregate (specific) turnover does not include value of inward/outward supplies on which tax is payable on reverse charge basis.

GST is leviable only if aggregate turnover is more than 20 lacs. (Rs. 10 lacs in 11 special category States). For computing aggregate supplies turnover of all supplies made by you would be added.

Separate registration as tax deductor is required.

Yes, You or your organization can or can be opt for composition scheme from the starting of the next financial year on submitting the option to take benefits of composition scheme before starting of the new financial year.

There is no such requirement under GST law.

For GST Certificate / Registration online, easily register your business on the official GST portal and just fiiling application form and upload all mandatory documents. You will then receive an TRN & ARN acknowledgement. Then GST Number will be provided on acceptance of the application and a temporary password and login will be sent on your registered email id.

In India 3 Kind of GST is applicable. CGST (Central Goods and Service Tax), SGST (State Goods and Service Tax), IGST (Integrated Goods and Service Tax).